Women Saving for Resilience: Transforming Lives Through Innovative Savings Group Solutions

PART 1

Women Empowered: the Power of Unity,

Courage, and Perseverance

Before we didn't have anything, only enough to eat and nothing more. But now our funds are growing, and we are giving loans. We are happy... I am no longer afraid.”

The day María Etelvina Díaz Carrillo met Élida Maribel Carrillo nearly two years ago changed the trajectory of her life and reshaped the future for her family and community.

María spent her whole life in Santiago Chimaltenango—a mountainous town in the highlands of western Guatemala. Known for its stunning landscapes and rich Mayan heritage, Santiago Chimaltenango is home to indigenous Mam people who—like María—speak the Mam language and share distinct cultural identity. Life in this beautiful, vibrant town, located just about 40 miles from the departmental capital of Huehuetenango, is not easy. Challenged by devastating hurricanes, droughts and the COVID-19 pandemic, families in the entire Department of Huehuetenango face persistent income insecurity and an unprecedented food security crisis. Many are compelled to rely on humanitarian assistance to put food on the table.

María’s and Élida’s shared story began in December 2021, when Élida visited Santiago Chimaltenango to support the formation of savings groups in María’s community Canton Palmita II. At that time Élida was a Women Empowered (WE) Facilitator with Global Communities’ Paradelante (“Forward”) program.

When Élida’ invited María and her neighbors to join a savings group, they hesitated. “We did not know how to form the group and we were afraid to speak up,” María says. Eventually, with Élida’s guidance and mentorship, María and six other women from her canton formed the Coffee Flower (“Flor del Café”) WE group and began a journey of saving together.

Participation in the WE group proved transformational for María and her fellow group members. First, they learned strategies to build savings, which increased their financial stability and provided an important safety net in case of emergencies. They finally had something to rely on not only for their daily needs and sustenance, but also for unforeseen circumstances. For example, the social insurance fund they established to support each other through difficult times provided a vital source of relief when one member suffered a stroke. Second, they gained new knowledge and skills, including financial literacy and public speaking.

When saving became a habit and funds in the cashbox began to grow, the Coffee Flower members started giving out loans, making larger purchases and even investing in small businesses.

In Huehuetenango, Global Communities has supported WE groups under several humanitarian assistance programs, including Paradelante, which provides direct cash transfers to families affected by food insecurity. In addition to covering food consumption needs, the transfers can be used as seed funding to jumpstart small businesses, which María capitalized on. Two cash transfers from Paradelante, paired with savings and loans from the WE group, allowed her to establish a successful juice and egg stand in her community. “I have had the business for a year now,” María says. “I sell orange juice. With the money we received, I also bought quails, and they are laying eggs… I am selling them by the dozen,” she adds. María’s entrepreneurial spirit did not end there. Now, she also sells enchiladas, chicken sandwiches, and handmade huipils—colorful tunics, which carry historical significance in many indigenous communities across Central America. María wore one proudly to the interview with us. It took her a month to weave it.

María spoke with deep appreciation about how the WE program has improved her family’s life. She could finally buy food for her two young children Miranda and Geitor, and supplement income generated by her husband Hermenegildo—a farmer specializing in producing organic fertilizer from animal waste. And she felt more prepared for natural disasters, heath emergencies, and unexpected economic setbacks.

In addition, the Coffee Flower became an invaluable source of social empowerment for María and other group members. “In the past, there were certain things we couldn't do, but now we have more rights and opportunities to rise up,” María says. “We come together to defend these rights.”

Over time, the group engaged in many discussions about social issues affecting their community, like the lack of schools and proper sanitation systems. The members also took action together, organizing clean-up campaigns, urging their neighbors not to litter, and advocating for women's rights. “Men now believe us that we have rights,” María says proudly.

Global Communities supported the Coffee Flower through August 2022. Now the group operates on its own as a self-sustaining entity. “We are working, and the group will continue,” María says with great conviction. “Now that we know our rights, we can grow more,” she adds.

One cannot help but smile when reading María’s story. Her words emanate hope and joy when she talks about the positive changes that WE has brought to her life. “I feel happy,” she says repeatedly. “We are happy to be a part of this group.” There is something profoundly remarkable that happens when people come together in the face of adversity. While the journey from crisis to resilience is never linear and most people oscillate between hardship and stability, we all gain much more than skills and resources to withstand shocks and stresses when we support each other. We gain a peace of mind. Research suggests that supportive social connections contribute to positive emotions, which can broaden people’s mindsets and coping strategies, further enhancing their resilience. No wonder that the Coffee Flower members feel joy and optimism. Together, they have created a brighter future not just for themselves but for their entire community. Their story is a testament to the transformative power of unity, courage, and perseverance.

PART 2

Our Approaches and Principles

Advancing Gender Equality and Women’s Empowerment

Savings groups—often referred to as informal community banks—are small groups of people who save together and lend to each other from their pooled funds. Globally as many as 500 million people belong to savings groups. Approximately 80% of members are women, and many savings groups programs are designed to advance gender equality. This is the quintessential principle of Global Communities’ WE initiative. While helping women build sustainable livelihoods, WE employes innovative solutions to promote women’s participation, leadership, and collective action, positioning them as confident agents of change in their homes and communities.

Photo by Tony Tseng

Photo by Tony Tseng

Enhancing Financial Inclusion and Economic Stability

Savings groups are widely recognized for promoting financial inclusion and improving livelihoods among low-income populations in underserved markets. WE members consistently report advances in economic outcomes, including significant increases in monthly savings and access to credit. These financial gains enable them to invest in income generating activities, withstand emergencies, and pay for things they otherwise could not afford—from food and schools supplies to agricultural inputs and household appliances.

Layering Behavioral Change & Crisis Resilience

Savings groups serve as important platforms for training and awareness raising. Global Communities often layers behavioral change with WE, for example by incorporating messaging around nutrition and personal hygiene in savings groups’ meetings. In fragile contexts, we also integrate WE with disaster risk reduction and humanitarian assistance. For instance, we provide emergency preparedness training and mobilize savings groups to engage in crisis response. In addition, we offer cash and asset transfers to assist members in their recovery efforts.

Fostering Social Cohesion and Collective Action

Savings groups play a powerful role in fostering social cohesion. By bringing women together around a shared purpose, they nurture the spirit of collaboration and build social capital, which is crucial to individual and collective empowerment. Savings groups also act as safe spaces for women, where they can support each other and practice leadership skills. Recognizing the immense potential of savings groups for leading collective action, Global Communities encourages conversations on social issues among WE members. During these dialogues, many groups identify challenges facing their communities and develop plans to address them through grassroots advocacy and community mobilization initiatives. The support system created by savings groups can be truly life changing. Our research shows that WE members who receive emotional support from their groups are better prepared for disasters and more confident to manage a crisis.

PART 3

Beyond the Core Curriculum:

Innovations in Savings Group Programming

Developed in 2008 and refined over the past 15 years, WE builds on the proven Village Savings and Loan Association (VSLA) methodology with the spirit of continuous innovation and adaptation. In addition to the core curriculum, the initiative incorporates novel approaches to transform harmful gender norms, encourage economic participation, advance financial inclusion in oral cultures, and champion digital transformation. Global Communities introduces these innovations based on program goals and specific needs of our participants.

Engaging Men & Transforming Gender Norms

Across the globe, women face persistent normative barriers to their economic empowerment, including their participation in savings groups. Threatened by the loss of power and control, men often resist women’s attempts to engage in economic activities and refuse to take a fair share of household responsibilities. To address these challenges, Global Communities has partnered with Equimundo to adapt Journeys of Transformation for WE.

Journeys of Transformation is a structured, gender-transformative intervention for couples. The program engages men as allies in women’s economic empowerment, fosters positive masculinities, and seeks to shift unequal gender norms and power dynamics present in couples’ relationships. Our adaptation engages WE members and their spouses in 13 educational sessions covering such topics as gender equality, sexual and reproductive rights, and violence against women.

Building on these positive results, Global Communities is currently implementing Journeys of Transformation with ten savings groups and 100 couples in Nicaragua.

Impact of Journeys of Transformation in Guatemala

Between 2020-21, Global Communities implemented Journeys of Transformation with 12 WE groups in nine communities of Cuilco, Guatemala. 11 groups completed the program and 98 couples graduated. The intervention led to positive outcomes, including improved communication between partners and more equitable division of labor at home. Women’s and men’s gender attitudes shifted as well. For example, we saw a greater support for women’s participation in saving groups and decision-making, and significantly reduced acceptance of intimate partner violence. Furthermore, the percentage of women participating in paid work doubled by endline to 20%, though some of this may be attributed to the agricultural cycle.

Supporting Entrepreneurship & Workforce Participation

Savings groups provide an invaluable opportunity to learn basic financial literacy skills, but this is often not sufficient to build successful livelihoods. To strengthen women’s economic participation, Global Communities has partnered with Gap Inc. to implement P.A.C.E. (Personal Advancement and Career Enhancement) life skills curriculum with WE members. P.A.C.E. develops skills in communication, problem solving, decision-making, and time and stress management.

Global Communities also offers business skills training to savings groups, covering such topics as business planning and management, marketing, and bookkeeping. Project META (“Goal”)—our more advanced business support program for WE members—provides business advice, small-scale startup transfers, and productive skills training, for example in animal husbandry and potato farming. These interventions promote the spirit of entrepreneurship and catalyze the progress that WE participants make in generating sustainable incomes, mostly in agricultural production.

Project META by the Numbers

Global Communities implemented META in two municipalities of Guatemala, reaching 155 women. Participants experienced a 63% spike in their average monthly income. In addition, their improved livestock management practices increased animal survival rates from 20% to 80%.

Championing Digital Transformation

The past decade has seen a growing investment in technology solutions for savings groups, which are increasingly using digital solutions—such as digital ledgers and wallets—to manage group records and conduct financial transactions. This leads to the emergence of digital savings groups (DSGs), which are groups whose procedures, records or transactions are digitized in some way, typically through the use of mobile phones and applications.

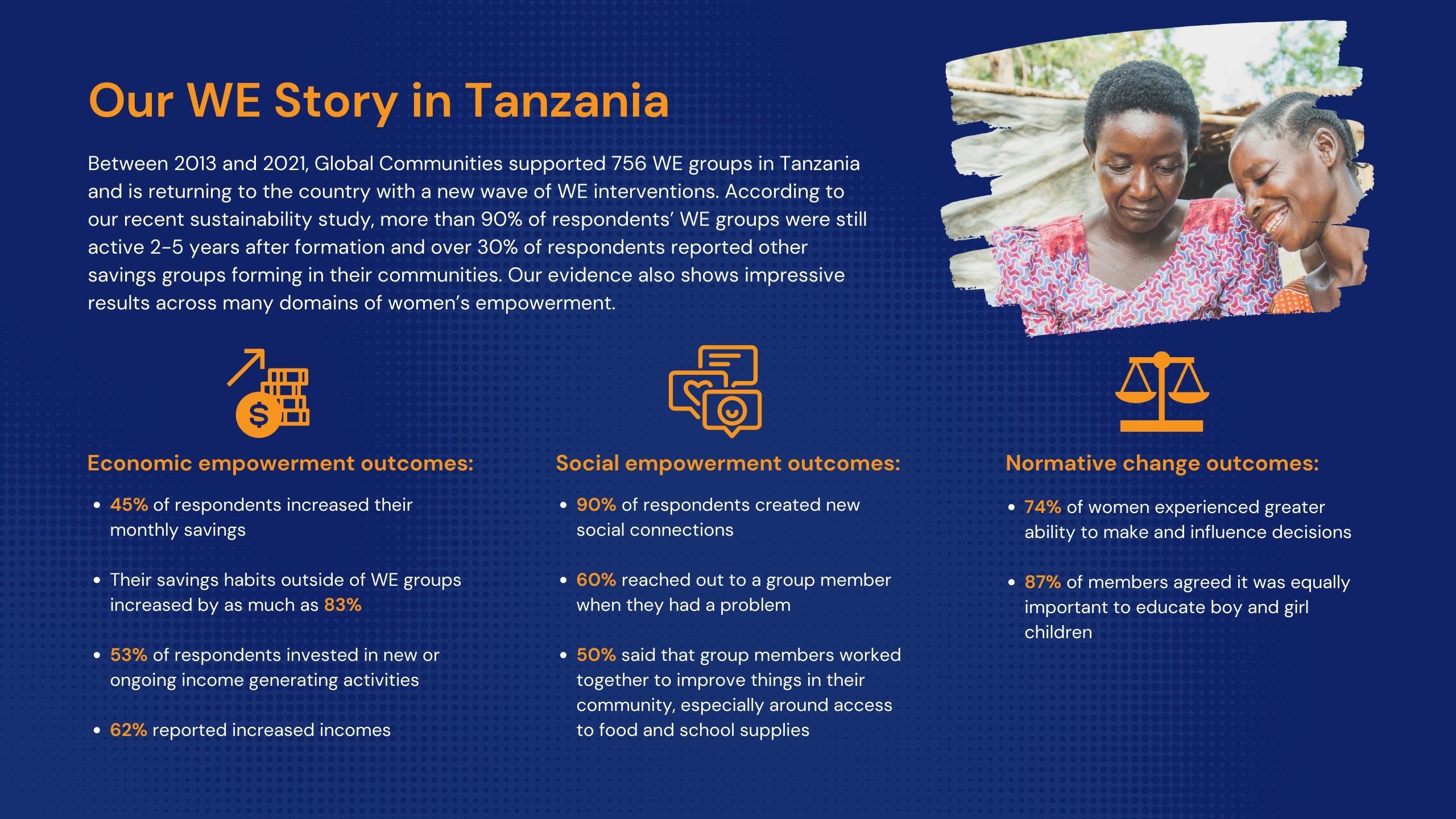

Global Communities began digitizing savings groups in 2019 in Tanzania using DreamSave—a digital ledger designed by DreamStart Labs—with 13 WE groups and nearly 300 individuals. We are currently digitizing WE groups in Ethiopia and preparing for another wave of digital transformation in Madagascar and Tanzania.

To address the risks and barriers to digitization, Global Communities has created the DSG Toolkit and other resources on safe, inclusive, and gender-responsive digitization of savings groups. We have also launched the DSG Hub—an online learning and community platform for DSG practitioners. The DSG Hub promotes innovation and is guided by a vision of financial and digital inclusion for all.

Photo by Tony Tseng

Photo by Tony Tseng

Assessing the Impact of Digitization

Emerging evidence demonstrates that digitization can have both positive and negative consequences for the ability of women to participate in and benefit from savings groups. On the one hand, going digital may save time, simplify recordkeeping, and minimize errors. For example, our pilot project participants in Tanzania reported a 66% reduction in time spent conducting financial transactions. Digitization may also encourage uptake of mobile technologies and expand digital identities, which is critical in the era of ecommerce. On the other hand, digitization comes with risks, such as data privacy violations and cybercrimes. Moreover, digitization happens in the world of persistent gender digital divide, where women’s access to mobile technologies is constrained by rigid gender norms, unequal power dynamics, and resource limitations. Studies also show that digitization can have significant impact on group membership and dynamics and often, this impact is gendered. For example, women may experience marginalization in mixed-gender groups, where men are often more tech-savvy and therefore more likely to play leadership roles.

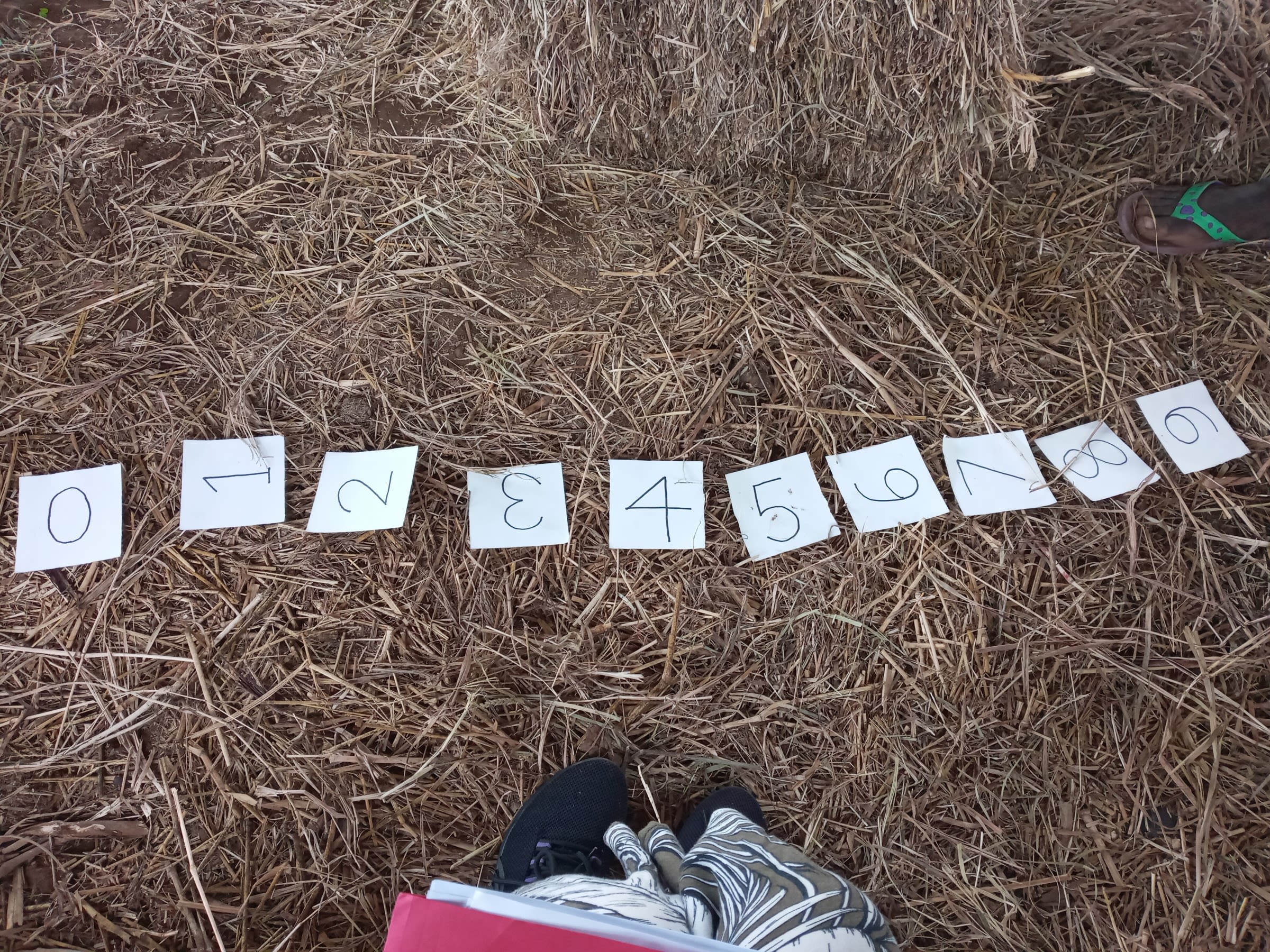

Advancing Financial Inclusion in Oral Cultures

As the world is entering an accelerated era of artificial intelligence and machine learning, nearly 800 million people globally are non-literate and nearly one billion are unable to read and write multi-digit numbers. Two-thirds of them are women. When communities share an unwritten mother tongue, all communication in that language is oral or visual. And while oral communities preserve rich cultural heritage and beautiful storytelling traditions, most cannot function well in the modern economy. Unable to understand financial amounts written on paper or screen, oral people are vulnerable to financial losses and fraud. Many avoid financial institutions altogether, and instead save in livestock, crops, and hidden cash, which is risky and unsustainable.

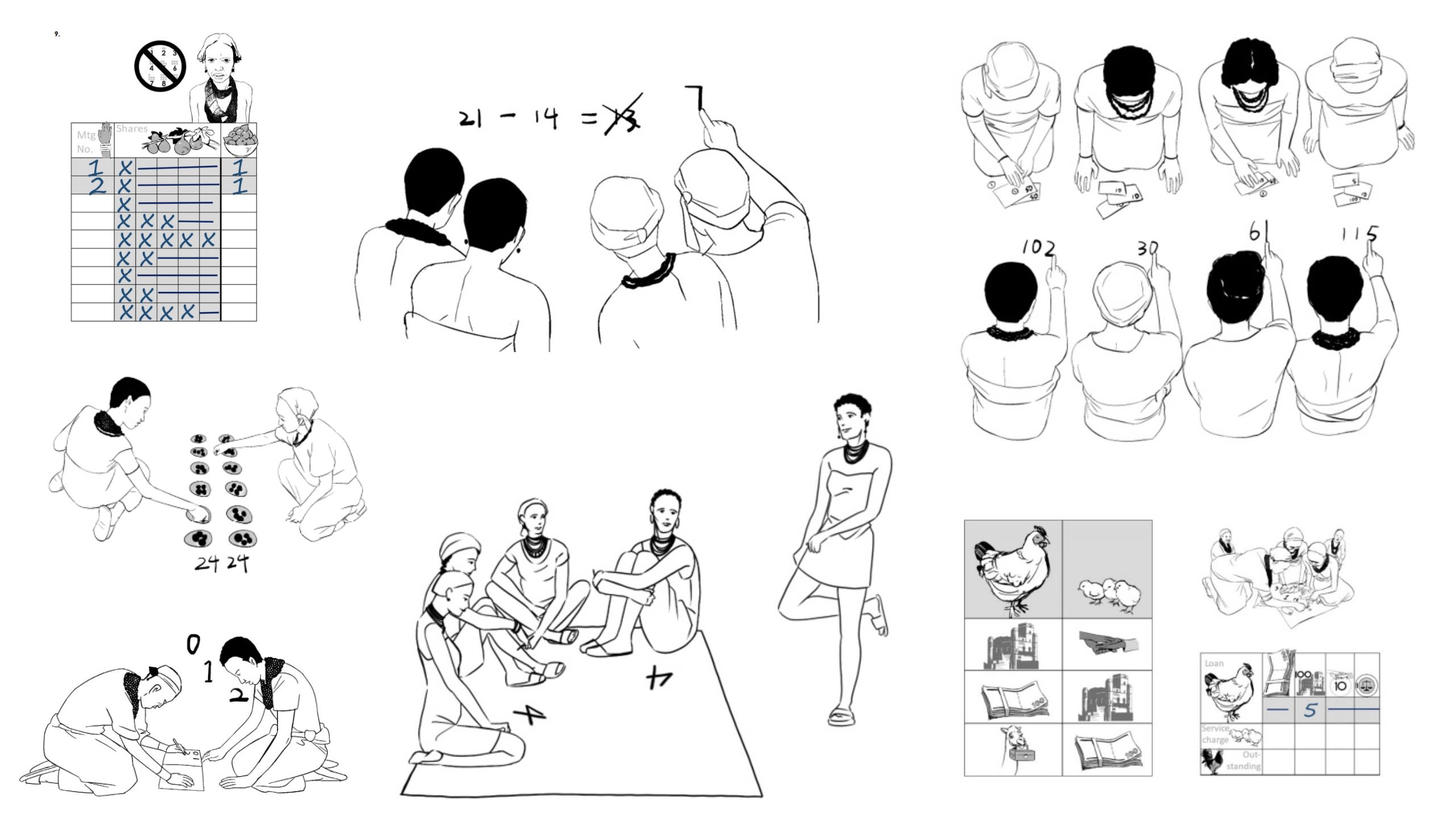

Women can reap many benefits from savings groups regardless of their numeracy skills, but not without stress and heavy reliance on outside assistance, mostly from men. To address this problem, Global Communities has partnered with My Oral Village to pilot an Oral Information Management (OIM) system with 12 WE groups in the pastoralist communities of the South Omo region of Ethiopia. The intervention teaches basic numeracy skills and creates custom oral recordkeeping tools, which are replacing complex, text-heavy passbooks and ledgers with culturally relevant pictures and icons.

Oral Information Management (OIM) system illustrations

Oral Information Management (OIM) system illustrations

First Lessons from Oralization Efforts

Our recent evaluation of the pilot has demonstrated that OIM gives WE members more autonomy over their group and their savings. Prior to the initiative, none of the participants were sure about balances in their cashbox and passbooks. At mid-term review, over 70% of respondents agreed with a statement, “I am confident that I know the amount of my savings and outstanding loans.” We have also observed that once WE members learn how to manage their money safely and independently, their mindsets change. They become more confident in their abilities, which is a crucial element of the empowerment process.

PART 4

Evidence, Impact, and a Path Forward

Our evidence collected over the years has shown considerable progress across many goals the WE initiative supports. On the personal level, WE members cultivate self-esteem, gain new skills, and increase incomes. They also feel more confident to start and manage a business. On the household level, WE participants report positive shifts in couples’ communication, more equitable decision-making, and decreased acceptance of intimate partner violence. And on the community level, WE members are more likely to engage in collective action, assume leadership positions, and benefit from social connections, including in times of crisis. These results, even if short-term, are real wins. Our evidence also points to high levels of sustainability and replicability of WE.

Each member has their own incredible story of change… They see new possibilities for what they can do, what changes they can make, and what goals they can achieve.”

When asked to reflect on the most significant change that that has occurred because of WE, Global Communities staff could not settle on one accomplishment or measure of success. “There are too many to choose just one,” Dennis Mello says, emphasizing that WE groups are often the only places where women can come together to focus on their own goals and needs. Mabel Bejerano agrees. “For me, WE is an initial step, a safe space for women to begin their personal growth paths,” she says. “WE helps them feel valued and supported. It inspires them to dream. And it elevates the voices of women in their communities,” she adds. According to Nataly Larios, WE groups give women an opportunity to set aside roles assigned to them by society and speak up, which is invaluable in an environment permeated with machismo and patriarchy.

Moving forward, Global Communities aspires to build on these results and continue growing an innovative, gender transformative WE program that systematically designs for women’s lived experiences and strengthens their resilience in times of crisis and relative stability.

At a time when disasters and disruptions are becoming more common and catastrophic, Global Communities, together with our local partners, equips communities with the training, tools and resources they need to recover from crises and build long-term resilience in the face of constant change.

From prevention and adaptation to positive transformation, we focus on solutions that center local voices and expand opportunities for growth, leadership and advancement.